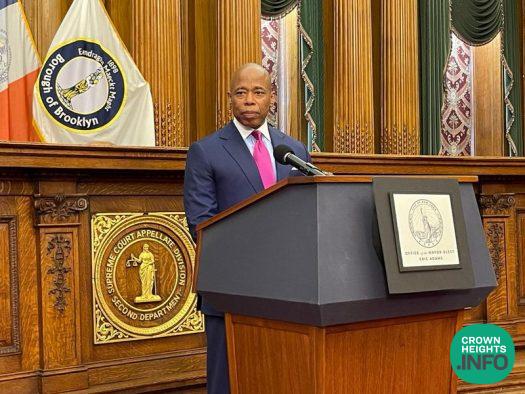

Mayor Adams Signs Legislation to Provide Property Tax Rebate For NYC Homeowners

New York City Mayor Eric Adams signed legislation to provide a one-time property tax rebate of up to $150 to hundreds of thousands of eligible New York homeowners. The bill was passed by the New York City Council earlier this month.

“I grew up on the edge of homelessness, so I know the worry and fear that too many low- and middle-income homeowners across the five boroughs experience about whether they can keep their homes and pay their bills,” said Mayor Adams. “We want to remove some of the burden that New Yorkers are feeling, which is why we are putting money back into their pockets with a property tax rebate of up to $150 to low- and middle-income homeowners. This is about delivering direct relief to homeowners in New York who are struggling to get by.”

Intro 600 — co-sponsored by New York City Council Speaker Adrienne Adams, New York City Councilmember and Finance Committee Chair Justin Brannan, and New York City Councilmember Kalman Yeger, and long championed by New York City Council Minority Leader Joe Borelli — will implement a state authorizing law, allowing the city to provide a rebate of real property taxes for eligible properties on Fiscal Year 2022 property taxes. The rebate would be the lesser of $150 or the amount of the property’s FY 2022 real estate tax liability.

To be eligible for the rebate, the property must be a one, two or three family residence or a dwelling unit in a cooperative or condominium; and the property must be the primary residence of the owner. In addition, the annual income of all the owners of the property must have been less than or equal to $250,000 in tax year 2020.

“From the very beginning, Mayor Adams promised a laser-focus on fiscal responsibility,” said New York City Councilmember Kalman Yeger. “Providing tax relief to New York City’s homeowners is fair, necessary and fiscally responsible. I’m grateful for the mayor’s strong support of this legislation, which will benefit hundreds of thousands of New York’s working families. In midst of an inflation and economic crisis touching every corner of our city, any relief we can give taxpayers is necessary. I’m honored to be part of providing this small measure of relief to New York City’s taxpayers, and I’m hopeful that this serves as a reminder that tax dollars belong to the taxpayers, not the tax spenders.”

Checks will be issued by the DOF to eligible homeowners. Fiscal Year 2023 recipients of a School Tax Relief (STAR) exemption or credit for whom DOF can verify eligibility will automatically receive checks, which will be sent out at the end of August.

DOF will notify — by letter — STAR recipients for whom DOF has incomplete income information. These property owners will be required to certify their eligibility to receive a check. An application process is being created for other property owners who do not receive the STAR exemption, but who may be eligible for the rebate. The additional information or application will be due in November, and checks will be sent out to owners that DOF determines to be eligible in the fall.

Me

Relief????

A crumb of a crumb and their busy patting themselves on the back.

Useless idiots.