After Purchasing Israeli Firm, Buffet Receives Rebbe Dollar

The Midwestern city of Omaha, Nebraska, nestled amid vast corn fields and cattle ranches, simmered with excitement on Wednesday. Warren Buffett, the city’s most famous resident, had just completed the acquisition of Israel’s Iscar company. After acquiring 80 percent of the company in 2006, he waited seven years, watched its value double, and then completed the deal.

This Saturday, 50,000 people will come to the city to hear the guru of the global economy, the Mozart of capitalism, speak. There is no question that his most recent acquisition will be the subject of many hours of chatter. Eitan Wertheimer, Iscar’s chairman, has a right to be pleased both personally and as an Israeli. He just carried out the deal of his life, and will now take (voluntary) early retirement. In addition, he has acquired the best possible public relations agent for the State of Israel.

In an interview with Israel Hayom, the world’s most famous investor heaped praise on the country: “Israel is a great place to invest because of its people. There is no other place in the world where you find people with these qualities, as well as with the motivation and the ability to focus that you see at Iscar.”

When asked for advice, Buffett replies, “I haven’t been to Israel recently so its hard for me to give advice, but I form my impressions from Iscar, and the company makes me believe that Israel has a bright future. Iscar will never stop, even if there is a slowdown in world markets. Iscar never stops innovating with new products and never stops satisfying its customers. With the excellent management at Iscar, I just sit in the back seat and let the car drive itself. I don’t have to do anything but rely on the management.”

According to Buffett, “Israel should continue to do what it’s doing. You are a nation of entrepreneurs with amazing abilities. Israel must continue to provide them with the best and most comfortable work climate. That is the government’s responsibility: to create a comfortable climate for entrepreneurs.

Searching for more opportunities

Buffett began his affair with Iscar in 2006, when he purchased an 80% stake in the company for $4 billion. On Wednesday he said, “We became partners, and that was a positive first step. Both sides were satisfied, and since there were no problems, we decided to take the next step. The deal was completed two days ago.”

To finish the Iscar deal, Buffett put in another $2 billion. But this may not be the last Israeli company Buffett invests in. When asked if he’s looking for more opportunities in Israel, he said, “I’m always interested. I’m waiting for a phone call or an offer. Do you have one?”

Buffett is one of the richest people in the world, but he plans to donate 99% of his wealth. “There are criteria, but I have five foundations that deal with this and they are run by my children and by Bill and Melinda Gates. It won’t help if someone comes knocking on my door, but you can take my wallet — just for a photograph.”

The Chabad dollar

Despite his many years of success, Buffett retains a youthful enthusiasm.

“Every morning, I’m excited to go work,” Buffett said. “I enjoy working.”

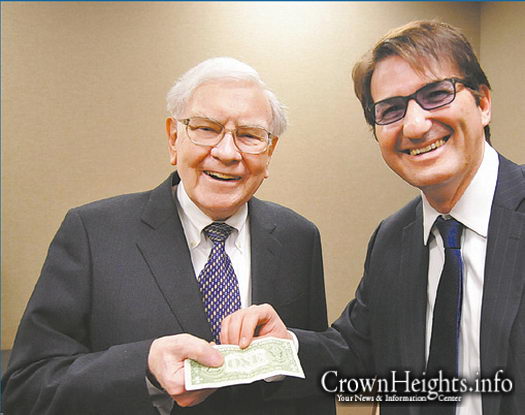

Before my meeting with Buffett, Chabad members asked me to give him a dollar blessed by the Lubavitcher Rebbe. I gave it to him at the end of the interview.

“You know, if I take this dollar with me to Israel, you’ll see how I will turn it into ten dollars in Israel,” Buffett said.

When I told him that the dollar was blessed, he immediately understood and said, “This will bring me luck? OK, I will keep the rebbe’s dollar.”

Before we left, Buffet was photographed with Wertheimer, and let Wertheimer have a photograph with his wallet.

“You can keep it,” Buffett said. “There is already nothing in it. You took $2 billion from me after taking $4 billion several years ago. Now, I just have the rebbe’s dollar.”